- Who We Help

- Solutions

- EnergyCAP UtilityManagement

Best-in-class portfolio-level energy and utility bill data management and reporting.

Best-in-class portfolio-level energy and utility bill data management and reporting.

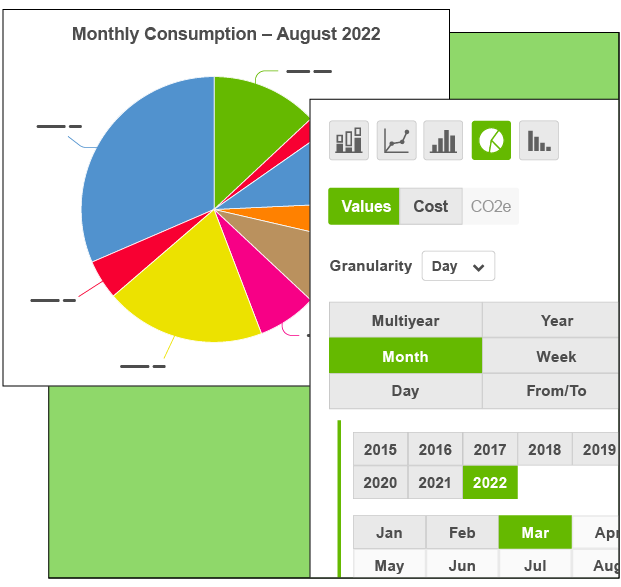

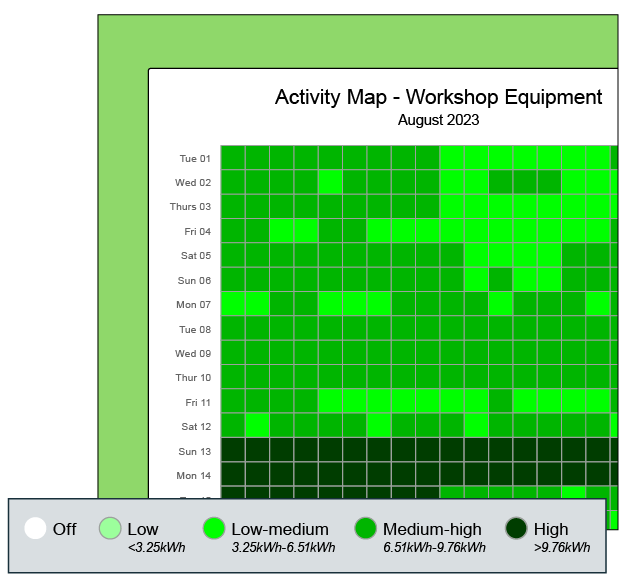

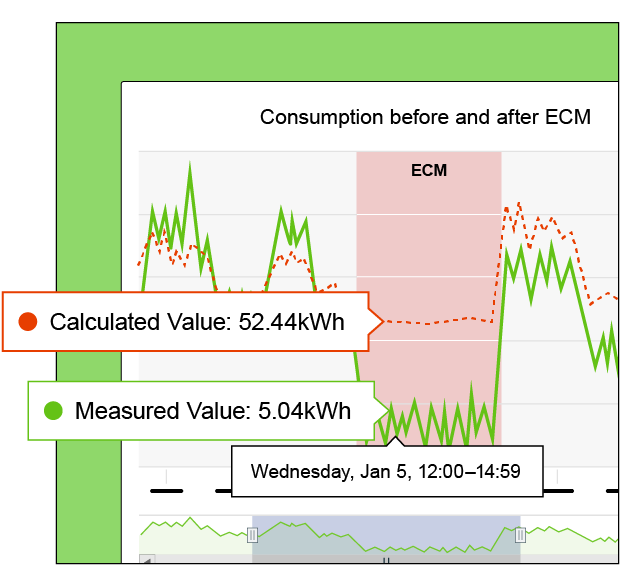

- EnergyCAP SmartAnalytics

Real-time energy and sustainability analytics for high-performance, net-zero buildings.

Real-time energy and sustainability analytics for high-performance, net-zero buildings.

- EnergyCAP CarbonHub

A holistic view of financial-grade scope 1, 2, and 3 carbon emissions data across your entire business.

A holistic view of financial-grade scope 1, 2, and 3 carbon emissions data across your entire business.

- EnergyCAP Utility Company Platform

Energy and sustainability benchmarking compliance software designed for utilities.

Energy and sustainability benchmarking compliance software designed for utilities.

- EnergyCAP UtilityManagement

- Success Stories

- Resources

- Company